If you are trying to get a loan and need the USSD code of your targeted bank, perhaps the sterling bank loan code in your case, you will find it right on this page.

Back in the day, receiving a loan typically entailed physically visiting the bank and going through a series of handwritten procedures, such as the following:

- acquiring a loan application form, filling it out

- and waiting for the acceptance of the loan after submitting it

To receive a loan, you have to leave your house, office, place of employment, or wherever else you might be. This can be a very difficult and time-consuming process.

Since the availability of the sterling bank loan code, it is now much simpler to obtain the loans you need within a few minutes and without having to take a footstep.

What is USSD

Unstructured Supplementary Service Data is what “USSD” refers to when it’s abbreviated as an abbreviation. It is sometimes referred to as the code or the USSD code. It’s common for people to get it confused with swift code, but the two are in no way equivalent.

They are codes that, as the name suggests, are used to gain access to various alternatives provided by your mobile telecommunications network provider. USSD can be utilized for a variety of purposes, including the provision of callback services, mobile money, content, and information, as well as the provision of services for the configuration of networks. In this particular instance, we look at how USSD can be utilized in banking and also how to use the sterling bank loan code.

How to apply for a loan using a sterling bank loan code

As of the time of publishing this post, the sterling bank loan code does not exist. Sterling bank does not have a USSD code for accessing a loan from the bank but an alternative way which is online.

We hope it will be available very soon, and when that happens, this post shall be updated with the sterling bank loan code. However, you can access other sterling bank services using the USSD code

*822#

.

How to apply for a loan using the sterling bank website

To apply for a sterling bank loan, follow the following steps:

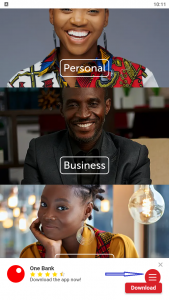

- Go to the sterling bank official website: The official website of the sterling bank is straightforward. It has the interface, as you can see here.

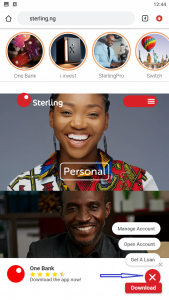

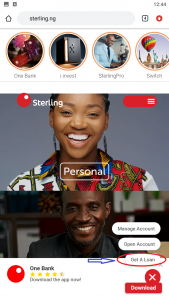

- Click on the hamburger icon in the bottom right corner of the homepage to have a popup that contains: Manage Account, Open Account and Get a Loan.

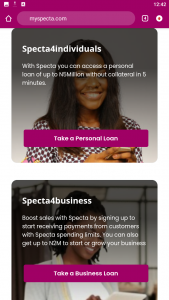

- Click on “Get a Loan”: You will be directed to the loan page, which contains the available loan options. Currently, sterling bank has two loan options on the loan page; Specta and Social Lender (not available at the moment).

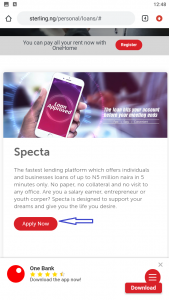

- Click on “apply now” under Specta: On clicking that, you will be redirected to the spectra page.

- Choose between “Take a personal loan” or “Take a business loan”.

Sterling Bank vs Specta

The Sterling Bank is the parent firm of the Specta Loan company. The loan application requirements of sterling bank’s customers inspired the establishment of the Specta Loan program. When you take out a loan through Specta, however, you are still considered to be doing business with the Sterling Bank.

You can acquire an instant cash loan of up to N5 million naira in Nigeria with the use of the Sterling bank specta Loan. This loan can be transferred to your bank account in a matter of minutes. The following deals and packages are available to you from Specta:

There is no need to profile participants in Specta Xtreme because it is open to everyone, including business owners, salaried workers, and others! You can borrow up to 2 million Naira with a maximum tenor of one year and an interest rate that ranges from 26 to 30 percent per annum, regardless of the bank you choose.

The Specta Basic product offers funding of up to 5 million in 5 minutes, a tenor of 4 years, and a rate and repayment date that can be customized. Only wage earners whose accounts are held in Sterling bank are eligible to apply for this. Business owners whose accounts are held at other banks are not eligible.

The Necessary Prerequisites for a Specta Loan

There are a variety of standards that must be met in order to qualify for a specta loan, but in general, you need to have these things:

- A number assigned to a bank account (Sterling bank account number is preferable)

- You must be at least 21 years old to participate.

- A number used to verify accounts at banks (BVN)

- A current and valid form of identification

- A valid email address

Conclusion

When you are in need of urgent cash or are seeking for a way to avoid the laborious physical means of receiving a loan, using USSD codes to gain access to loans is an excellent option. They have very few prerequisites, and if you satisfy all of the standards, the approval process for your loan should take only a few minutes.

[ruby_review_box]